How to invest your money

and build your wealth

How to build wealth requires people to invest their money wisely by diversifying their assets, staying informed about market changes, and making regular contributions to their investments.

It doesn’t matter where you are at right now, we will take the time with you to help map an investment pathway for you to reach and build your wealth.

Increasing wealth includes structuring cash flow to maximize surplus, giving you more funds to save, invest, and grow effectively.

Using your cash surplus wisely helps you make strategic financial decisions that align with your long-term goals and wealth-building strategy.

Maximising your financial position by focusing on net assets strengthens stability and builds a solid foundation for long-term financial success.

As well as exploring diverse investment opportunities allows you to grow wealth sustainably, ensuring a more secure and financial future.

Why Invest

Getting ahead financially is not about how much you earn, but how much you keep. There are plenty of people who earn low to average incomes during their working life, yet enjoy the pleasures that saving and investing bring. Maybe it is frequent holidays, maybe it is a holiday home; maybe it is accumulating enough to help the kids buy their first homes; or maybe it is about taking a semi retirement or sea change prior to being able to use your super.

Whatever the reason, it needs to be YOUR reason. Your own specific reason for investing is your motivation and this will be a strong driver of the success of your investment plan. This will give you the motivation to do all the right things that will see your goal(s) materialise.

Budget and Investing Money

Have you ever done a budget and found out you should have a surplus but still can’t seem to save as much as you would like? Or maybe you should have a surplus but you still can’t save anything? You are not alone!! It is seriously like money just disappears into thin air.

Of all the people we have seen at Financial Planning Qld over the years, nobody has saved all of their “surplus”. In fact, most people before seeing us had not saved ANY of their “surplus”. Hanging on to that elusive dollar is definitely a challenge sometimes.

The reason for this is that a budget does not make a plan – it just tells you what you have to make a plan with. An investment plan will organise your cash flow in a way that the investment just happens and then money stops “disappearing into thin air”.

Now, it is VERY adventurous to make a plan expecting to invest ALL of your surplus, but around 50% of your “budget surplus” is probably a fair place to start. Developing strong budgeting skills, considering debt consolidation, and maintaining a good credit score can also help you manage your finances more effectively.

How to Build Wealth

When you spend time with us, ultimately, we want you to feel confident knowing you have a much brighter financial future to look forward to. We are a team of passionate and dedicated financial planning professionals who are committed to helping professionals and families improve their financial outcomes throughout Brisbane, Queensland, and, for that matter, Australia!

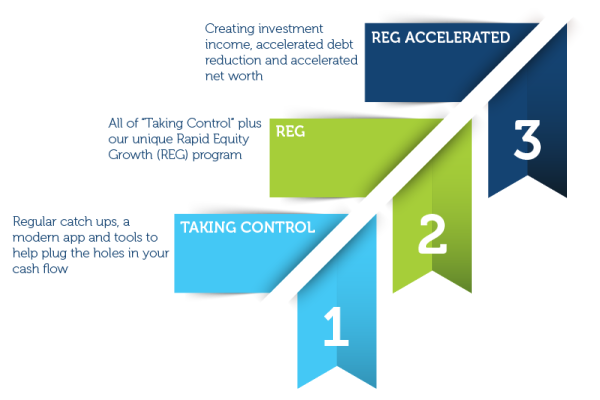

We will move you from Stage 1 through to Stage 3 over time and as you become comfortable and ready for the next stage. You move at your own pace and no one is rushed. Although we usually recommend that people come on board at Stage 1, in some cases, you may join us at Stage 2 or even Stage 3. However, this is only possible if we mutually agree that you are ready to enter at that level.

Taking Control

Giving you confidence to enjoy your life, whilst being focused on your big picture

We will guide and support you to…

- Plug the holes in your cash flow

- Provide you with money saving tips

- Ensure that every dollar has a purpose

- Personalised wealth creation catch ups with your financial advisor

- Hold you accountable to ensure financial success

- Regular, complete wealth & cash flow reports

Rapid Equity Growth (REG)

Rapid Equity Growth (REG), stage 2, takes all of “Taking Control” PLUS…

- Strategic Advice by means of Personal Financial Planning

- Access to our Model Portfolio

- Rapid Debt Reduction Plan to become debt free

- Risk Management

- Smart allocation of surplus cash to debt & savings

- Returns higher than bank interest on savings

- Basic Will

Giving you choices sooner than you think, whether it’s becoming debt-free, buying your first or another property, continuing to invest, or even all of the above.

REG Accelerated

At this stage which we call REG Accelerated, includes all of REG plus the capability to…

The key takeaway to building your wealth

We go beyond making systematic plans. Our goal isn’t just to change your super or investment products. Financial management is more than simply giving you a budget, handling your money, or helping you get a month ahead on bills. Instead, we focus on understanding your objectives, offering guidance based on our deep expertise, and presenting you with options. With the right tools and knowledge, you can take control of your financial future and build lasting wealth.

We provide financial planning services to enable you to make smart decisions when it comes to areas such as paying off debt faster, saving money, investing, retirement planning, Centrelink, and age pension. We offer a range of services that can help nurture your financial growth and security, including budgeting skills, debt consolidation, and maintaining a good credit score. As a full-service financial planning firm, we ensure you have a positive and fulfilling experience with us and that you actually get ahead financially.

Our approach includes strategies on how to build wealth, maximise your current financial position, and suggestions for increasing wealth. We aim to help you diversify your financial toolkit and focus on building your wealth effectively.

If you have a goal, we can start to put together a strategy that will get you there.

So if you’re tired of living from paycheck to paycheck, want more information on the elusive dollar, and want to get ahead, give me a buzz on (07) 3162 1449 for a free chat or fill in the form and I will get back to you as soon as I can.